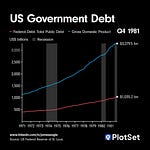

The US now pays over $1 trillion in interest on its debt.

More than on defense.

More than on Medicaid.

Yet, that's still only ~3% of GDP. So should we be worried, or can America afford it?

Why this might not matter

➡️ Relativity check: The bill looks monstrous in cash terms, but as a GDP slice we're back to late-'90s territory.

➡️ Dollar privilege: The Fed controls the supply of US dollars and the world still queues to buy US Treasuries. Despite recent US Treasury sell-offs, there's little alternative as a reserve asset for central banks apart from Gold.

Why this might be a cause for concern

➡️ Confidence fragility: A tariff shock, inflation flare-up, or Trump's "Big Beautiful Bill" could jolt bond vigilantes awake. A sell-off could see this interest expense rise dramatically from this trillion dollar level.

➡️ More credit risk is now being priced in since Moody's downgrade, which could also make US debt more expensive to service in the future.

Takeaways

💡 Dollar dominance buys time, not immunity. A credibility wobble could see that interest expense rocket far higher than 3%-of-GDP.

💡 There are unknown-unknowns or black swans. If there is a suddenly crisis, the US government has very little fiscal maneuverability to protect the economy,

Do you have any thoughts on this topic?

Music: Lock Stock by The Big Let Down, Epidemic Sound