Tesla's explosive energy business has slowed

Five charts to start your day

Good morning – here are your five chart for the day.

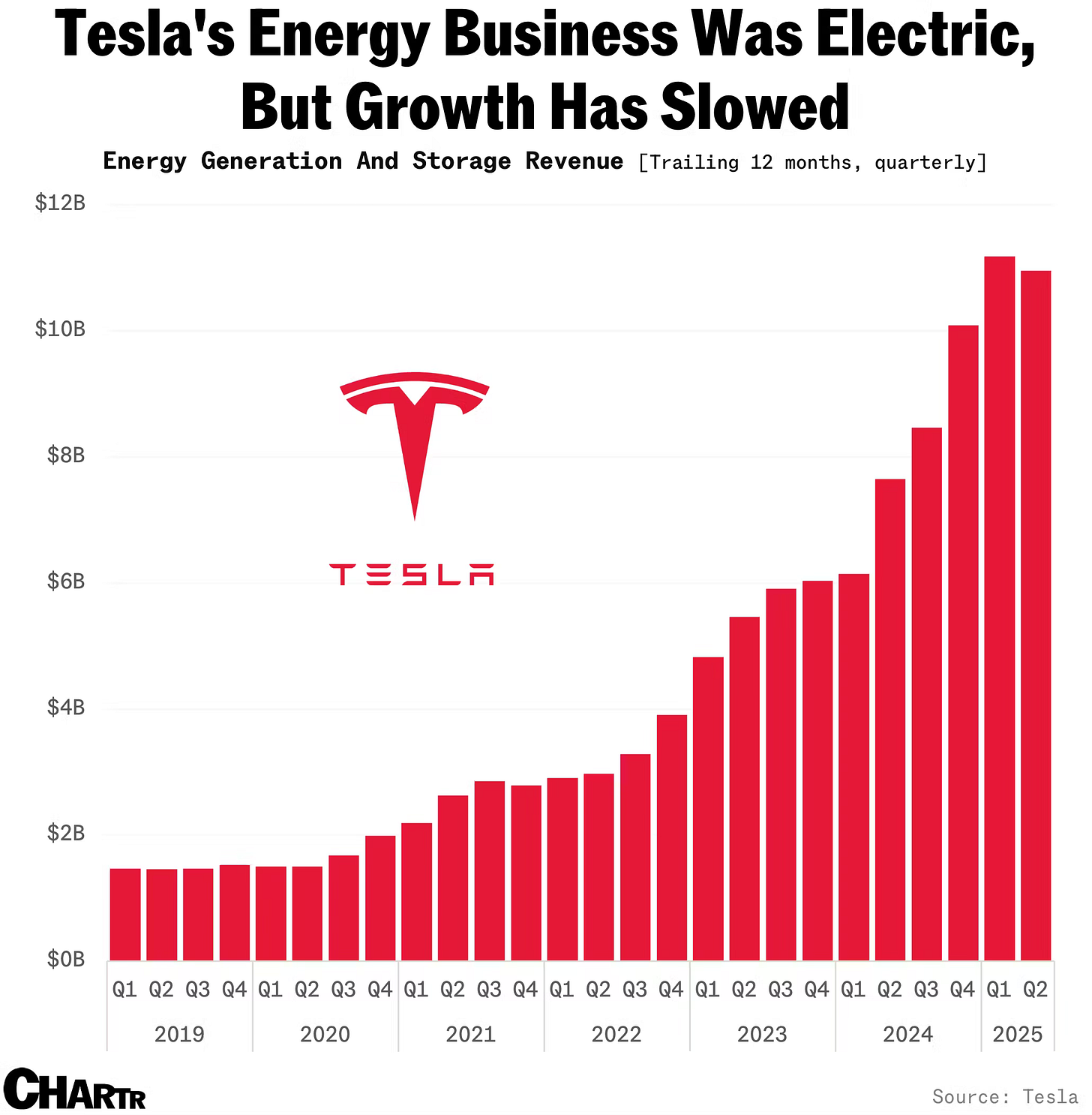

CHART 1 • Tesla energy generation and storage revenue

Tesla's energy business has quietly become its brightest spot, rocketing from $1.5 billion quarterly revenue to over $11 billion in just six years. The company deployed a record 11 GWh of energy storage in Q4 2024, while Q2 2025 installations reached 9.6 GWh, down slightly from Q1. Revenue from energy storage and solar installations grew from $2 billion in 2020 to $10.1 billion in 2024. The growth trajectory is remarkable.

What Tesla used to deploy in an entire quarter back in 2022 – 1.6 GWh – is now just the quarterly increase. Tesla expects storage deployments will grow at least 50% this year, driven by AI data centres' insatiable power demands. The Megapack factory in California has fully ramped, with Shanghai coming online in 2025. Margins are exceptional – 30.5% gross margin in Q3 2024, a company record.

But the plateau is concerning. After years of exponential growth, deployments have stalled around 10-11 GWh quarterly. Competition from CATL and others is intensifying. Supply constraints persist. While auto sales slide, energy storage provides vital revenue diversification – yet even this star performer shows signs of maturity.

Source: Chartr

Want the other four? Become a paid subscriber.