Five charts to start your day

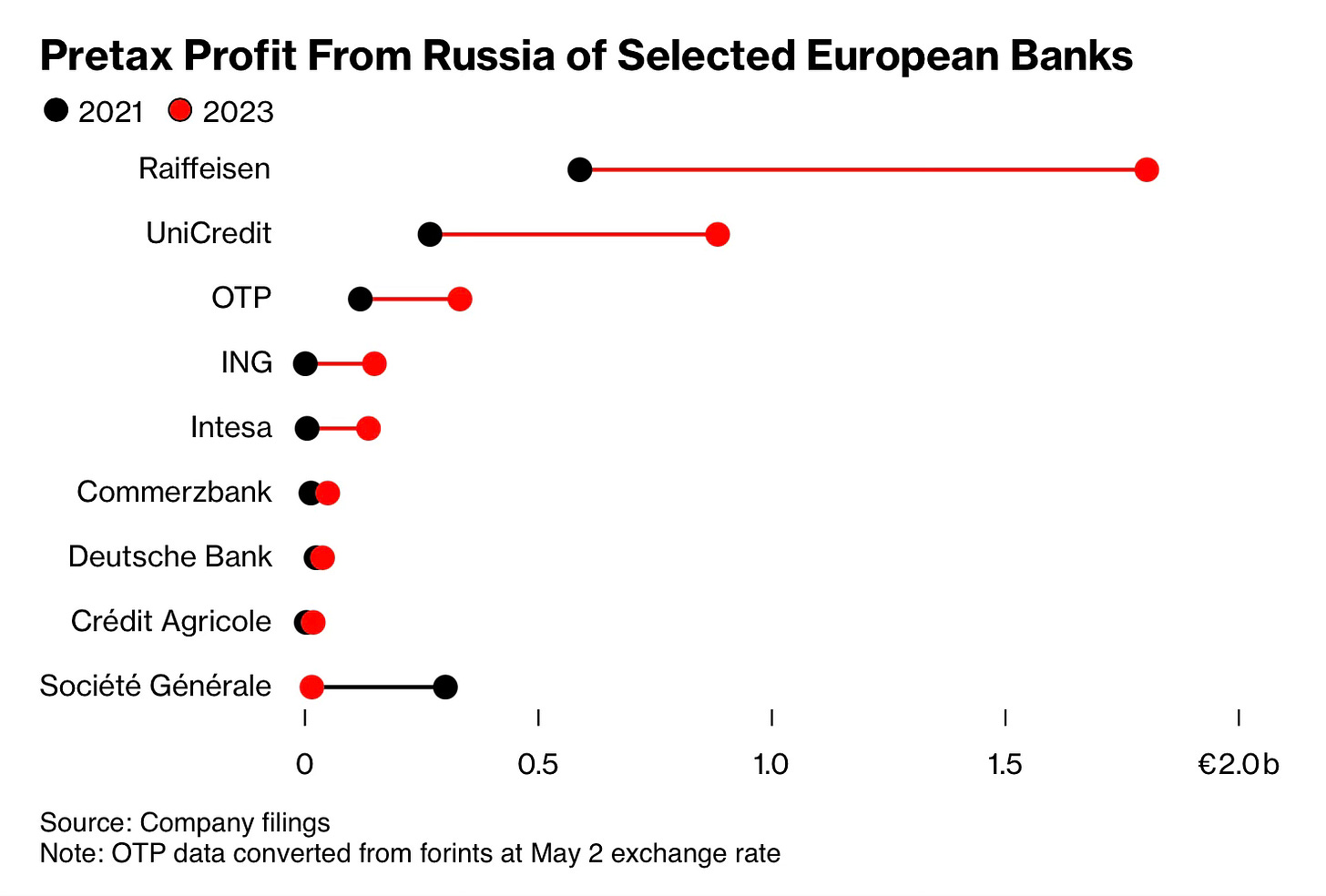

Trapped in Russia Raiffeisen and other European banks see profits soar

Raiffeisen, one of Europe's largest lenders, has been struggling to exit Russia after the country invaded Ukraine. Despite public pledges to wind down operations, Raiffeisen has seen its profits from Russia more than triple since 2021, thanks to the country's high-interest rates.

Efforts to repatriate capital have been stymied by Western regulators' reluctance to approve transactions, leaving the bank at risk of violating sanctions. While Raiffeisen claims to have significantly reduced its Russian loan book, its employee count in the country has actually grown. The bank's predicament highlights the difficulties of selling Russian units, which require Kremlin approval. As the war drags on, Raiffeisen finds itself trapped, unable to extricate itself from a profitable yet perilous market.

But Raiffeisen is not alone in this struggle. Many other European banks have found themselves in a similarly difficult situation, trapped between their commitments to leave Russia and the challenges of actually doing so. UniCredit, Italy's largest bank, has set aside hundreds of millions of euros to cover potential losses in Russia, while Hungary's OTP Bank has managed to move some money out of the country despite the regulatory hurdles.

As the war grinds on and sanctions tighten, these banks face a stark choice: continue to profit from a pariah state or take a painful financial hit to cut ties. The European Central Bank is ramping up the pressure, but untangling from Russia's complex web of regulations and political risk is proving to be a slow and arduous process. The longer these banks remain, the greater the reputational and financial risks they face.

Source: Bloomberg

Coming up:

China's demographic time bomb can now be heard ticking

Millennials in the US are having fewer children

The stunning collapse of 30-year US Treasury bonds

Credit card defaults hit record levels

If you like the sound of that line up, this is usually a paid newsletter. You basically get all my best ideas daily. Hit the subscribe button if you are interested and this will be sent to your inbox daily.