Five charts to start your day

Top 10 stock concentrations in the S&P 500 reach new highs

You know they come in peace. All they want to do is live long and prosper. In doing so, they have made the US the most innovative country on the planet (or so some claim), which justifies those trillion-dollar valuations.

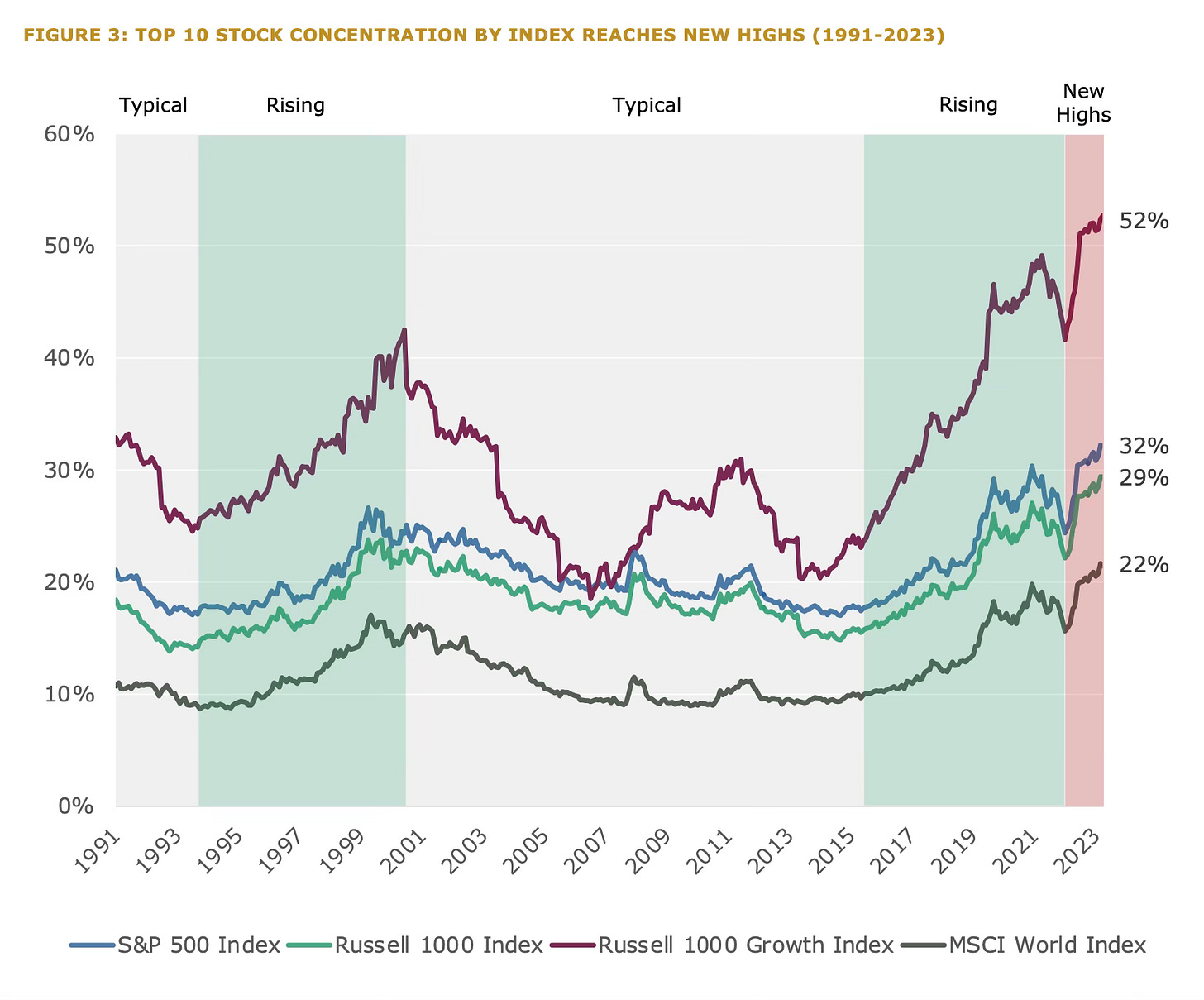

During most of last year, the US stock market was fixated on just a few major technology players – the Magnificent Seven. They wielded significant power within the S&P 500 and greatly influenced market behaviour.

The chart below from Intech Investments clearly illustrates just how much of the S&P 500 they managed to conquer. I must admit not all of the top ten stocks here are mega tech names, but nonetheless, these businesses did have an influence on these concentration levels. So much so that a new high of 52 per cent was reached.

So, will this continue? Probably not. A new trend is emerging. Well, it’s not really a trend, but more of a broadening out of the bull market in the US. Called the “everything rally” by some, a wide range of companies are now doing well, across many different industries and sectors. Essentially, the bull market has moved beyond the mega-techs.

This change means investors have more options. It might also mean that these high concentration levels for the top ten stocks might also begin to start falling.

Source: Intech Investments

Coming up:

Global valuation of unexited companies hits $3.2 trillion

India’s economy has navigated three decades of ups and downs

Is NVIDIA Overpriced? Analysing its PE ratio and EPS

Unpacking the $545 Billion semiconductor industry revenue

If you like the sound of that line up, this is usually a paid newsletter. You basically get all my best ideas daily. Hit the subscribe button if you are interested and this will be sent to your inbox daily.